If you’re still looking for a credit card that actually makes sense for your wallet, stop right now.

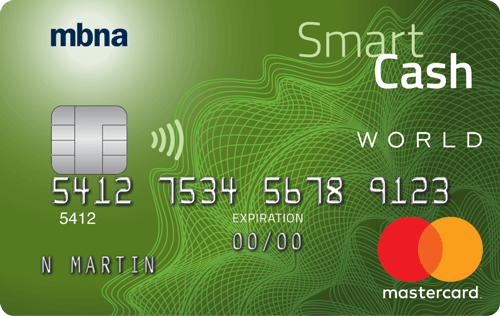

The MBNA Smart Cash Platinum Plus Mastercard is one of the smartest choices!

Anúncios

MBNA Smart Cash Platinum Plus Mastercard: Pros and Cons You Need to Know

Choosing a credit card can feel overwhelming, especially when so many promise perks that sound great on paper but fall short in practice. That’s why doing your homework is crucial before committing to any card. The goal isn’t just to have another plastic in your wallet, it’s to make sure that card works for you, supports your lifestyle, and brings tangible benefits to your financial routine.

The MBNA Smart Cash Platinum Plus Mastercard stands out as a practical, no-nonsense solution. Unlike cards that focus on complex points systems or luxury perks you’ll rarely use, this card gives you something far more straightforward — real cashback on everyday essentials like groceries and gas.

Plus, it comes with one of the most appealing offers in its category: a high cashback rate in the first six months, and best of all, no annual fee ever. But even the most promising card has its trade-offs. Is the MBNA Smart Cash truly as rewarding as it seems? Or are there limitations you should know before applying?

In the breakdown below, we’ll walk through the most relevant advantages and disadvantages of this card — so you can make a confident, well-informed decision based on what truly matters to you.

Advantages of the MBNA Smart Cash Platinum Plus Mastercard

1. Up to 5% cashback in the first 6 months

During the promotional period, the card offers one of the highest cashback rates on daily expenses — up to 5% on gas and groceries, with a $500 monthly cap. A great incentive to start using it from day one.

2. Ongoing cashback on essential spending

Even after the welcome offer ends, the card continues to provide 2% cashback on gas and grocery purchases (within the monthly cap), plus 0.5% on all other purchases.

3. Zero annual fee — forever

You don’t pay anything to keep the card active. That means every dollar of cashback is net profit, with no fixed costs eating into your rewards.

4. Fast, fully online application process

The application is entirely digital — quick, secure, and easy. No paperwork, no lengthy waiting, just a few steps to get started.

5. Free additional cards

You can add up to nine authorized users at no extra cost, making it ideal for families looking to combine expenses and boost cashback earnings together.

6. Extra security and protection benefits

The card offers purchase protection against theft and accidental damage, plus extended warranty coverage on eligible items — an excellent perk for added peace of mind.

7. Smart installment plans for large purchases

Allows you to split larger expenses into 6, 12, or 18-month terms without relying on high-interest revolving credit — helping you stay in control of your budget.

Disadvantages of the MBNA Smart Cash Platinum Plus Mastercard

1. Monthly cashback cap on top categories

The 2% (or 5% during the promo) cashback only applies to up to $500 in combined monthly spending on groceries and gas. If you spend more than that, your cashback drops to 0.5%, which may limit earnings for high-volume spenders.

2. Low cashback on other categories

Purchases outside of gas and groceries only earn 0.5% cashback — not ideal for those who spend heavily in other areas like entertainment, dining, or travel.

3. High interest rates if you carry a balance

As with most credit cards, interest rates for purchases, cash advances, and balance transfers are relatively high (ranging from 19.99% to 24.99%). If you don’t pay your bill in full, your cashback could easily be wiped out by interest.

4. Not the best card for frequent travelers

The card doesn’t include travel-focused perks such as points, miles, or waived foreign transaction fees. For travel rewards, other cards may offer better value.

5. No rewards on cash advances or ATM withdrawals

Cash advances and similar transactions don’t earn cashback and still accrue interest immediately — making them a poor use of the card.

Conclusion: Is It Worth It?

The MBNA Smart Cash Platinum Plus Mastercard is an excellent choice for those who spend regularly on groceries and gas, prefer cashback over points, and want to avoid annual fees at all costs.

If you manage your finances well, pay your bill in full, and are looking for a simple way to earn money back on purchases you already make, this card delivers solid value — straightforward, efficient, and rewarding.

On the other hand, if you’re more interested in travel perks, want higher rewards in diverse spending categories, or tend to carry a balance, you may want to explore other options.

The ideal choice always comes down to your lifestyle, spending habits, and what you expect from a credit card.

Website