Anúncios

Have You Ever Stopped to Think That You Might Be Spending More Than You Should?

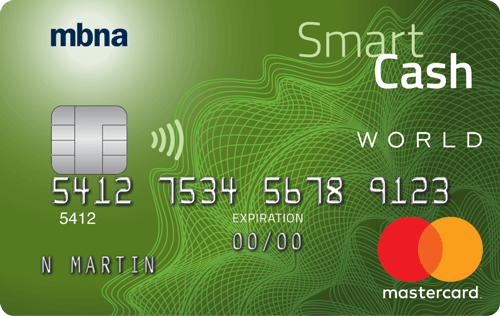

The MBNA Smart Cash Platinum Plus Mastercard is more than just a credit card — it’s a smart tool for those who want to turn everyday expenses into real savings.

If you’ve ever wondered whether it’s worth having a no-annual-fee card that offers direct cashback on groceries and gas, the answer is right here.

In times of high prices and tight budgets, every cent counts. And what if you could get back part of what you spend each month, without changing your routine or paying hidden fees? With this card, not only is that possible — it’s easier than you think.

In this article, you’ll understand why this card is among the best options for Canadian residents who want practicality, savings, and financial control — all within a rewards system that is simple, straightforward, and beneficial.

What Is the MBNA Smart Cash Platinum Plus Mastercard?

The MBNA Smart Cash Platinum Plus Mastercard is a credit card designed for everyday use. It recognizes that most people’s recurring expenses are concentrated in two essential categories: groceries and fuel. Instead of ignoring this pattern, it rewards it.

While many cards focus their rewards on categories that don’t necessarily match the average consumer’s lifestyle, such as airline tickets or hotel stays, the MBNA Smart Cash Platinum Plus offers direct cashback on the expenses that weigh most heavily on your monthly budget.

The system is simple: the more you use it, the more you get back — as long as you pay your bill on time, of course.

What’s more, the card has a strong appeal: there’s no annual fee. In other words, you can keep the card active and enjoy its benefits without any fixed costs. It’s a rare combination in the market: simplicity, real rewards, and zero annual fee.

First 6 Months: A Financial Boost That’s Worth Its Weight in Gold

Once approved for the card, new holders unlock a highly attractive welcome offer. For the first six months, the card offers 5% cashback on gas and grocery purchases. This rate is among the highest available in the no-annual-fee card category.

However, this reward comes with a monthly limit of $500 in combined purchases in those two categories. That means you can earn up to $25 in cashback per month during the promotional period. If you reach the limit every month, that totals $150 in cashback in just six months.

What’s most interesting is that this benefit is easy to access. Simply use the card as usual when fueling your vehicle or shopping for groceries. In other words, there’s no need to change your consumption habits — just the card you use to pay.

This initial phase is an excellent opportunity for anyone looking to balance their budget, build an emergency cushion, or simply make smarter spending decisions. It’s the kind of advantage that generates immediate results, with no need to accumulate points or deal with complex reward systems.

After the Initial Period: Cashback That Keeps Giving

After the sixth month, the cashback doesn’t disappear. It simply transitions into a more sustainable long-term model — still highly advantageous.

The standard structure becomes:

- 2% cashback on gas and grocery purchases, capped at $500 in combined monthly spending

- 0.5% cashback on all other purchases made with the card

So, even after the promotional period ends, the MBNA Smart Cash Platinum Plus remains an excellent tool for those with consistent expenses in key categories.

For example, someone who spends around $400 a month on groceries and gas would earn $8 in cashback each month — nearly $100 a year. And remember, this comes with no annual fee. Few reward programs offer that level of return so directly.

Additionally, the cashback is automatic. There’s no need to redeem points, log into any platform, or meet extra conditions. The money is either credited to your account or applied as a statement credit.

Interest Rates and Fees: No Surprises, Everything Upfront

A credit card should be, above all, transparent. The MBNA Smart Cash Platinum Plus lives up to that by presenting its fee structure clearly.

- Purchase interest rate: 19.99% per year

- Cash advance interest rate: 24.99% per year

- Balance transfer interest rate: 22.99% per year

- Annual fee: $0

These rates are in line with the Canadian market average for cards in this category. However, it’s important to remember: interest only applies if you carry a balance or miss a payment. To maximize your rewards, always aim to pay your full statement balance by the due date.

That way, every dollar earned in cashback becomes a real gain, rather than being offset by finance charges. Responsible card users can truly turn this card into a powerful savings tool.

Extra Benefits: More Than Just Cashback

While cashback is the highlight of the MBNA Smart Cash Platinum Plus Mastercard, it also offers other benefits that enhance its overall value.

Here are some key features:

Purchase Protection

Items bought with the card are covered against theft or accidental damage for a specific period. This adds an extra layer of peace of mind, especially for high-value purchases.

Extended Warranty

Eligible purchases receive an automatic extension of the manufacturer’s original warranty, offering added protection for electronics, appliances, and other durable goods.

Customizable Payment Plans

Large purchases can be split into manageable payments based on pre-set terms of 6, 12, or 18 months. This flexibility helps cardholders manage their budgets without relying on high-interest revolving credit.

Free Additional Cards

You can add up to nine authorized users on the same account at no extra cost. This makes it easier to track household spending and increase cashback earnings by consolidating purchases.

Who Is This Card Best For?

The MBNA Smart Cash Platinum Plus Mastercard is perfect for a specific type of consumer. It shines in the hands of those with controlled spending habits, who prefer direct rewards and avoid paying unnecessary fees or interest.

It’s a great fit for:

- Families with regular grocery and fuel expenses

- Young adults looking for a simple and rewarding card

- Retirees and self-employed professionals with routine spending

- Anyone who wants to earn without paying — literally

On the other hand, it might not be ideal for those who prioritize travel rewards, mileage programs, or tend to spend more in categories like entertainment, fashion, or international travel.

How to Apply for the Card

Applying for the MBNA Smart Cash Platinum Plus Mastercard is a hassle-free, fully digital process, designed to offer convenience and security from the very first step. You don’t need to leave home, wait in line, or deal with long phone calls — everything is done online in just a few minutes.

Step-by-Step Guide to Apply

Visit MBNA’s official website

Start by visiting the dedicated page for this card on the MBNA website. There, you’ll find all the updated details about the product, plus an “Apply Now” button that leads to the online application form.

Website

MBNA Smart Cash Platinum Plus Mastercard

Fill out the online form

The form will ask for your personal and financial details, such as:

- Full name

- Residential address

- Date of birth

- Phone number and email

- Current occupation

- Gross annual income

- Monthly expenses (e.g., rent, mortgage)

These details are essential for a responsible credit evaluation. The platform is secure, encrypted, and follows modern data protection standards.

Review and submit your application

Once completed, review your information carefully. A final click on the submit button confirms your request. In many cases, approval is near-instant. Depending on your profile, the decision can be made within minutes or a few business days.

Card delivery

If approved, your card will be issued and mailed to your registered address. Delivery usually takes between 7 to 10 business days. Once you receive it, just follow the activation instructions — and you’ll be ready to start earning cashback.

Who Can Apply?

The MBNA Smart Cash Platinum Plus Mastercard is available to Canadian residents who meet the following basic eligibility criteria:

- Residency: Must be a permanent Canadian resident with a fixed address

- Age: Must have reached the legal age of majority in your province or territory

- Credit history: While MBNA doesn’t publicly disclose a minimum score, a healthy credit history with on-time payments and no recent delinquencies is recommended

- Income: No specific income threshold is required, but your financial situation will be evaluated based on your stated income and expenses

These criteria help ensure the card is offered responsibly, protecting both the applicant and the financial institution.

Conclusion: A Card That Gets the Basics Just Right

The MBNA Smart Cash Platinum Plus Mastercard proves that you can enjoy real advantages from purchases you already make. With a transparent cashback program, no annual fee, and practical everyday benefits, it stands out as a smart choice for anyone seeking financial control without sacrificing convenience.

If you regularly spend on groceries, fuel, and everyday expenses, this card not only fits your lifestyle — it rewards it month after month.

But what if you’re looking for a card that goes beyond cashback and offers additional perks for international travel, no foreign transaction fees, and more purchase protections?

Then you won’t want to miss our next article about the Home Trust Preferred Visa.

Recommended Content