Se você valoriza economias reais, este cartão é a escolha certa para turbinar suas compras do dia a dia.

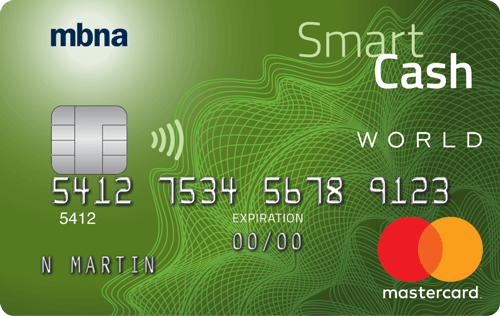

Maximize suas economias com o MBNA Smart Cash Platinum Plus Mastercard para multiplicar suas recompensas.

Anúncios

Ao avaliar qualquer cartão de crédito, é importante analisar atentamente o quadro geral: as vantagens que agregam valor e as desvantagens que podem afetar sua estratégia financeira.

O MBNA Smart Cash Platinum Plus Mastercard se tornou uma escolha popular em todo o Canadá, especialmente para pessoas que querem economizar mais em compras do dia a dia sem pagar uma anuidade.

O que torna este cartão atraente é sua estrutura simples: gaste em compras de supermercado e gasolina e ganhe dinheiro de volta. Para famílias que alocam grande parte do seu orçamento mensal nessas categorias, as recompensas podem aumentar rapidamente. No entanto, como qualquer produto financeiro, existem certos limites e condições que devem ser considerados com cuidado.

Nas seções a seguir, detalharemos as vantagens e desvantagens mais relevantes para que você possa determinar se este cartão é a opção certa para seu estilo de vida e hábitos de consumo.

Vantagens.

1. Alta taxa inicial de reembolso.

Um dos benefícios mais atraentes do MBNA Smart Cash Platinum Plus Mastercard é a generosa promoção de cashback de 5%. Nos primeiros seis meses, os titulares do cartão podem obter economias significativas simplesmente usando o cartão em supermercados e postos de gasolina.

Como essas categorias representam despesas recorrentes e inevitáveis, a oportunidade de ganhar recompensas sem mudar sua rotina é muito valiosa.

2. Recompensas contínuas.

Após o período de lançamento, o cartão continua a oferecer um valor significativo. Os titulares do cartão recebem 2% de cashback em compras de supermercado e gasolina, até CA$ 500 por mês.

Embora a taxa seja menor que os 5% iniciais, ela ainda oferece economias consistentes em duas das categorias de gastos mais comuns. Além disso, a cada duas compras, você ganha 0,5% de cashback, garantindo que nenhuma transação fique completamente sem recompensa.

3. Sem anuidade.

Para muitas pessoas, as taxas anuais podem diminuir rapidamente o valor de um cartão de recompensas. O MBNA Smart Cash Platinum Plus Mastercard elimina essa preocupação, oferecendo todos os seus benefícios sem anuidade. Esse recurso permite que você maximize suas recompensas sem se preocupar em compensar um custo anual.

4. Compre proteção e garantia estendida.

Outra vantagem são os recursos de proteção integrados. As compras feitas com o cartão têm cobertura contra roubo ou danos por até 90 dias, o que adiciona uma camada extra de segurança na compra de itens de maior valor.

Além disso, a garantia estendida dobra a cobertura do fabricante em até um ano adicional, dando tranquilidade para eletrônicos, eletrodomésticos ou outros produtos qualificados.

5. Descontos em aluguel de carros.

Os titulares do cartão também têm acesso a descontos nas locadoras de veículos Avis e Budget ao pagar com o MBNA Smart Cash Platinum Plus Mastercard. Esse benefício é particularmente útil para viajantes frequentes ou para quem aluga veículos ocasionalmente, pois se traduz em economias reais e tangíveis em despesas de viagem.

6. Segurança e conveniência.

A segurança é um aspecto essencial de qualquer cartão de crédito, e este produto inclui diversas medidas para garantir transações seguras. Com a proteção de Responsabilidade Zero, os titulares do cartão não são responsabilizados por compras não autorizadas.

Combinado com a tecnologia de chip e PIN e a conveniência dos pagamentos sem contato, os usuários podem ter certeza de que suas transações são protegidas e eficientes.

7. Usuários autorizados.

Famílias ou indivíduos que desejam centralizar gastos podem adicionar até nove usuários autorizados adicionais sem custos adicionais. Esse recurso facilita o acompanhamento das despesas domésticas, acumula recompensas mais rapidamente e simplifica a gestão financeira entre vários usuários.

Desvantagens.

1. Limites de cashback.

Embora as recompensas em dinheiro sejam atraentes, elas têm limites. As recompensas elevadas de 5% e 2% se aplicam apenas até CA$ 500 por mês em compras de supermercado e gasolina. Para famílias maiores ou indivíduos com gastos mensais mais altos nessas categorias, esse teto pode parecer restritivo, já que gastos adicionais rendem apenas a base de 0,5%.

2. Taxa básica mais baixa.

O cashback de 0,5% em todas as outras compras não é tão competitivo em comparação com outros cartões que oferecem recompensas fixas em todas as categorias. Isso significa que, se seus gastos forem diversificados e não se concentrarem em compras de supermercado ou gasolina, você poderá ganhar menos do que com opções alternativas.

3. Altas taxas de juros.

Como a maioria dos cartões de crédito, o MBNA Smart Cash Platinum Plus Mastercard vem com taxas de juros relativamente altas: 21.99% para compras e 22.99% para adiantamentos em dinheiro ou transferências de saldo.

Manter um saldo pode compensar rapidamente as recompensas que você ganha. Portanto, este cartão é mais benéfico para pessoas que pagam seus saldos integralmente todos os meses.

4. Categorias limitadas.

As melhores recompensas do cartão se limitam a apenas duas categorias: compras de supermercado e gasolina. Embora isso seja adequado para muitas famílias, pode não ser ideal para quem gasta mais em outras categorias, como viagens, restaurantes ou compras online.

5. Curto período promocional.

A taxa inicial de cashback do 5% dura apenas seis meses. Após esse período, a taxa de recompensa diminui, reduzindo o apelo a longo prazo. Para usuários que valorizam recompensas altas e constantes, esta oferta por tempo limitado pode ser decepcionante.

Conclusão.

O MBNA Smart Cash Platinum Plus Mastercard é uma excelente opção para pessoas e famílias que desejam maximizar a economia diária em itens essenciais, como mantimentos e gasolina.

A combinação de alto retorno inicial em dinheiro, ausência de anuidade, proteções integradas e vantagens adicionais, como descontos em aluguel de carros, faz com que seja uma escolha atraente para consumidores preocupados com o orçamento.

No entanto, ele tem suas limitações. Os limites de gastos, a taxa básica de recompensa relativamente baixa e as altas taxas de juros fazem com que seja mais adequado para titulares de cartão disciplinados que pagam seus saldos integralmente e gastam principalmente nas categorias de bônus.

Em última análise, o valor deste cartão depende dos seus padrões de gastos pessoais. Se o seu orçamento estiver alinhado com compras e gasolina como despesas principais, este cartão pode gerar economias significativas e oferecer um excelente custo-benefício sem anuidade. Mas se os seus gastos forem mais diversificados ou você tende a manter um saldo devedor, explorar outras opções pode ser mais vantajoso.

Site